Simplifying Fuel Tax Compliance for Commercial Carriers

What Is the International Fuel Tax Agreement (IFTA)?

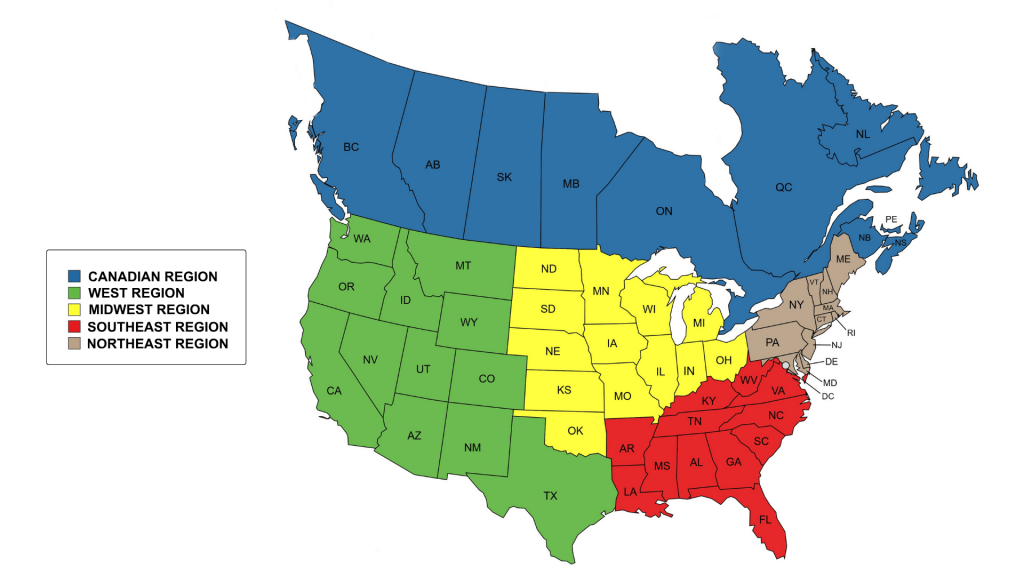

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among 48 U.S. states and 10 Canadian provinces, designed to simplify fuel tax reporting for motor carriers operating across multiple jurisdictions. By consolidating fuel tax reporting into a single quarterly return, IFTA eliminates the need for trucking companies to file separate reports for each state or province they travel through.

Staying compliant with IFTA is crucial for avoiding penalties and ensuring seamless operations across borders. Read on to learn how it works and what you need to do to stay in compliance.

How IFTA Works

IFTA simplifies fuel tax collection and distribution among member jurisdictions. When a motor carrier purchases fuel, taxes are paid at the pump. At the end of each quarter, the carrier submits an IFTA report detailing miles traveled and fuel purchased in each jurisdiction. Based on this information, taxes are either refunded or owed to ensure fair distribution among the jurisdictions where fuel was used.

Who Needs an IFTA License?

Motor carriers must obtain an IFTA license if they operate in two or more IFTA jurisdictions and meet the following criteria:

- Have a qualified motor vehicle, which includes:

- Vehicles with two axles and a gross vehicle weight exceeding 26,000 pounds.

- Vehicles with three or more axles, regardless of weight.

- Any vehicle used in combination when the total weight exceeds 26,000 pounds.

IFTA Reporting and Compliance

To maintain compliance, carriers must:

- File quarterly fuel tax reports with their base jurisdiction.

- Maintain accurate records of miles driven and fuel purchased.

- Pay any fuel taxes owed or claim refunds if applicable.

Failure to comply with IFTA regulations can result in penalties, fines, and even license revocation.

The IFTA Amendment Process

As a regulated system, IFTA undergoes periodic amendments to improve efficiency and address emerging industry needs. Changes to IFTA regulations can impact tax rates, reporting requirements, and compliance procedures, making it essential for carriers to stay informed about updates.

Ensuring Compliance with IFTA

Compliance is a key responsibility for all IFTA license holders. Carriers should:

- Keep detailed records of all fuel purchases and trip mileage.

- Store records for at least four years in case of audits.

- Accurately complete and submit quarterly tax reports on time.

- Understand penalties for late or inaccurate filings.

Need Help Navigating IFTA Requirements?

Managing IFTA compliance can be complex, but you don’t have to handle it alone. Transport Specialists is here to assist you with:

IFTA registration and renewals

Quarterly tax report preparation

Compliance audits and recordkeeping

Contact our team today to ensure your business remains compliant and avoids costly penalties!